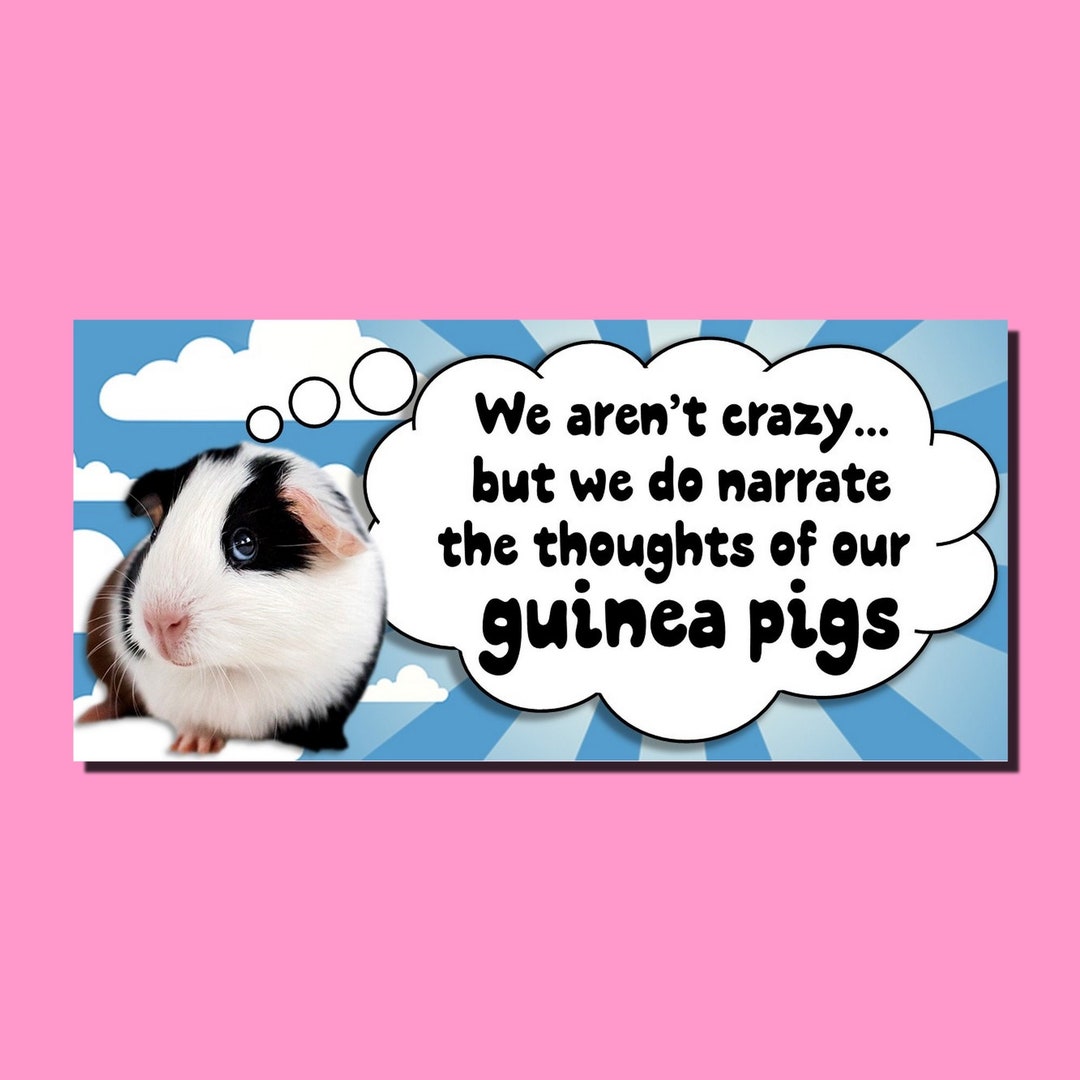

Listen up, I gotta tell you about this wild dream I had a few months back. It sounds dumb, but I’m telling you, it was a hard, cold warning. I was dreaming about my niece’s little fluff-ball guinea pigs, right? Only these weren’t the quiet, squeaky little guys. They were snapping. They were lunging. Little tiny teeth going chomp chomp chomp at my wallet, at my hands, at everything I tried to hold onto. I woke up genuinely sweaty, thinking, “What the hell was that?”

Now, I’m not some mystic guy, but the dream stuck with me. And honestly, I should have paid attention immediately, because about three days later, my whole financial life went sideways. It wasn’t a big, obvious thing—it was exactly those small, aggressive bites the dream warned about. I had this dude, a “friend” of a coworker, who swore by this crypto staking setup. He pitched it as a “set-it-and-forget-it” guaranteed 15% return. I should have known better, I absolutely should have, but I was blinded by the guaranteed number. Free money, I thought. I went all in with a solid chunk of my emergency savings.

The first month was great. Made a few hundred bucks. I even bragged about it a bit, feeling smart. The second month? Radio silence. I started checking the platform three times a day. Error messages. I started calling the guy who sold me the idea. His phone went straight to voicemail. Then his number suddenly became “unrecognized.” It didn’t crash; it just vanished. Poof. Like that whole little project was just a scam designed to take small, quick, aggressive bites out of people. It was exactly those angry little guinea pigs coming to collect their toll.

I was absolutely floored. I’m talking about sitting in the dark, wondering how I could be so stupid. That money was supposed to be for our mortgage down payment, man. We’re talking a life-changing amount, just gone. I remember my wife asking me, “Did you call the police?” and me having to tell her that I’d invested with some random dude I met one time at a backyard BBQ. I felt like the biggest, most useless idiot on the planet. The silence in the house was brutal. We had to immediately stop everything we were planning and start playing catch-up just to pay the basic bills. Forget savings; we were just trying to stay afloat. It was pure hell, just like being locked out of your life savings by an invisible enemy.

The Great Financial Overhaul: How I Dragged Myself Back

That shame, that feeling of being utterly bitten and exploited by something small and relentless, forced me to totally restructure how I handled my money. I didn’t just budget; I went full paranoia mode. I treated every single financial transaction like a potential predator. Here’s exactly what I did, step by painful step, starting the very next morning:

- I grabbed every single piece of financial paper. I mean paper, digital, credit card, utility, insurance—everything I could lay my hands on from the last two years. I spread it all across the dining room table like a crime scene investigator.

- I established the “Money Diary.” Not a fancy app, just a cheap, spiral-bound notebook. I started manually writing down every single dollar that moved out of my account. I wrote it. Seeing that outflow physically, with a pen, made it real.

- I tracked the “leaks.” This was the biggest surprise. I saw exactly what the small, aggressive expenses were. Those monthly subscriptions I never used, that daily $5 coffee. I calculated how many total guinea pig bites those were adding up to every month. It was shocking how much I was hemorrhaging without noticing.

- I waged war on non-essentials. I didn’t email; I called and spent hours arguing with people to cancel old gym memberships, three different streaming services, and a stupid magazine subscription. I watched the savings stack up immediately just from cancelling things I forgot existed.

- I created the “Mouth Guard Fund.” This is what I call my new emergency reserve. I focused on saving enough to cover six full months of living expenses, and I put it in the most boring, low-interest savings account I could find. It’s untouchable. Zero fancy investments, zero risk. If a guinea pig bites, this mouth guard absorbs the entire shock.

- I started buying the most boring stuff imaginable. No more hot tips. I started investing monthly into simple, broad-market index funds. The kind that grows at 7% a year. Slow and steady wins the race. I decided 7% was a hell of a lot better than the guaranteed 0% I got from the scammer.

The point is, the aggressive guinea pig dream wasn’t about the stock market crashing or something huge. It was a warning about the small things—the things you ignore because they seem too tiny to matter. The tiny little debts, the friend’s “sure thing,” the subscriptions you forget about. Those are the little teeth that will eventually gang up and take a massive chunk out of your foundation and your sanity.

I’m finally back on solid ground now, but it took a brutal lesson to get here. If your gut—or your subconscious, or whatever—is flashing a warning sign, even if it looks like something cute and fuzzy is mad, you need to stop and check your balance sheet right now. Don’t wait until the little bites become a crippling injury that derails your future. Take it from a guy who learned the hard way: sometimes the smallest warnings are the loudest. Go check your money, now. Seriously.